n Various elements influence credit mortgage approval, including your credit rating, earnings stage, employment standing, and any present debts.

n Various elements influence credit mortgage approval, including your credit rating, earnings stage, employment standing, and any present debts. Lenders assess these aspects to determine your financial stability and reimbursement capability, making them essential in the decision-making proc

Moreover, Daily Loans could be a double-edged sword. While they supply fast money, they may result in monetary pressure if not managed correctly. As such, assessing the aptitude to repay the loan on the designated due date is important for accountable borrow

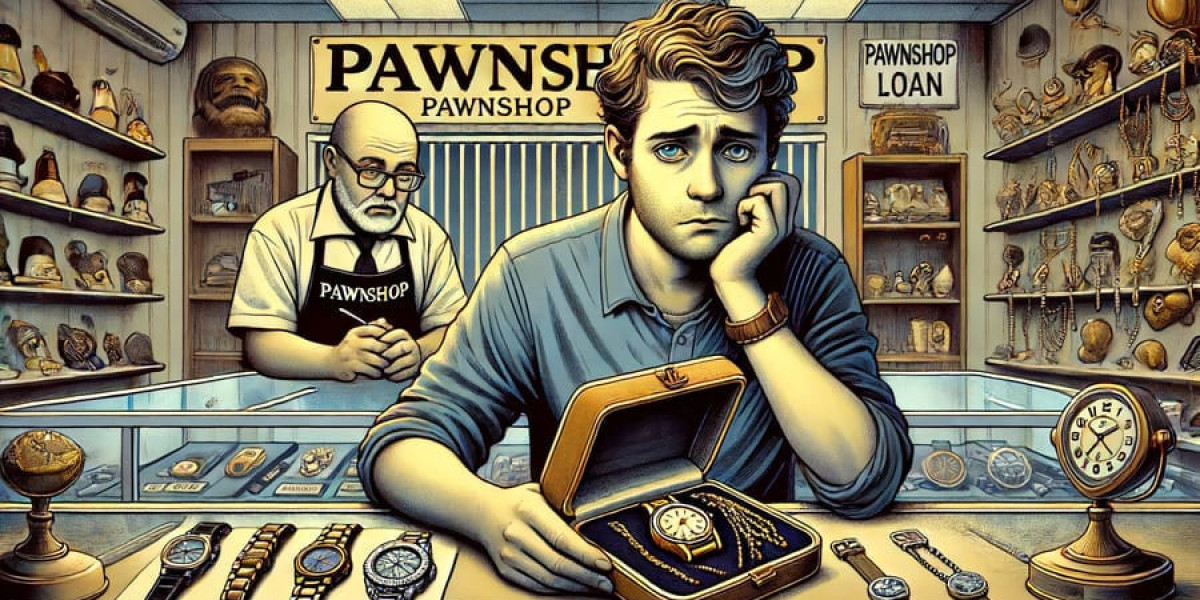

n You can pawn a big selection of items, including jewellery, electronics, instruments, and musical devices. pawnshops sometimes assess the condition and market worth of these things before figuring out the loan quant

The site’s user-friendly interface permits guests to navigate easily through the obtainable assets, serving to them make knowledgeable decisions. From learning about potential pitfalls to accessing customer evaluations, BePick is an indispensable device for these considering a Daily L

Understanding Pawnshop Loans

Pawnshop loans are short-term loans that use your

Personal Money Loan property as collateral. When you pawn an item, you receive a mortgage primarily based on the merchandise's assessed worth, and also you get to keep the item while repaying the loan. Typically, the loan term lasts for 30 to ninety days, after which you must repay the loan with curiosity to get your item back. If you fail to repay, the pawnshop retains your item, which they will res

Understanding Interest Rates

Interest charges are essential in figuring out the entire

click through the next article price of a credit score mortgage. They can significantly affect monthly funds and the overall reimbursement amount. Lenders contemplate several elements when setting interest rates, together with the borrower's credit score rating, the quantity borrowed, and the loan phrases. Generally, these with higher credit scores will qualify for lower rates of inter

Effective administration of Daily Loan repayments is crucial for maintaining monetary well being. Establishing a clear price range for reimbursement might help be sure that funds are allotted appropriately. Borrowers should plan their finances ahead of time to keep away from lacking payment deadli

Look for pawnshops that are licensed and have been in

Business Loan for a significant period. A reliable pawnshop usually has a strong reputation and good standing inside the community. Also, make inquiries about their terms and situations earlier than agreeing to a l

Finally, Additional Loans can present the flexibility needed for varied monetary conditions, allowing for more personalized monetary planning and administration. Borrowers can make the most of these funds strategically to raised their financial stand

In a world where financial literacy is essential, BePick goals to bridge the data hole. It acts as a beacon for day laborers, who could not have the sources to interact with monetary advisors or banks traditionally. The info provided on the positioning can make the distinction between borrowing from a predatory lender or finding a fair d

What is a Credit Loan?

A credit score loan is a sort of mortgage that allows borrowers to entry a set quantity of funds based on their creditworthiness. This mortgage could be a essential resource in occasions of want, offering the liquidity to address urgent monetary concerns. Typically, credit loans may be divided into two major classes: secured and unsecured loans. Secured loans require collateral, reducing danger for the lender, while unsecured loans don't. The rates of interest associated with these loans usually hinge on the borrower's credit score, revenue, and total monetary well be

n Pawnshop mortgage phrases typically final between 30 to ninety days. However, some retailers might provide extensions or renegotiations for the loan period. It's crucial to make clear the terms with the pawnshop before agreeing to a mortg

n Many borrowers contemplate taking an Additional Loan for a big selection of causes, corresponding to masking unexpected medical bills, financing house renovations, or consolidating present debt. It allows flexibility in managing monetary challenges when extra assets are wanted shortly. Moreover, it can help significant investments similar to education or beginning a business, facilitating higher monetary growth potentialit

Common Misconceptions There are several misconceptions surrounding Day Laborer Loans that may deter potential debtors from looking for financial help. One common fantasy is that these loans at all times include excessively excessive interest rates. While some might function higher rates than traditional loans, many corporations try to offer aggressive charges, significantly to cater to the distinctive wants of day labor

Another noteworthy benefit is the flexibility in borrowing amounts. Most lenders allow debtors to request various amounts, starting from small sums to bigger figures, relying on their needs. This flexibility allows people to tailor their borrowing to their particular situati

Exclusive Companion Services in Dubai: A Luxurious Experience

Par Kawthar AlJābir

Exclusive Companion Services in Dubai: A Luxurious Experience

Par Kawthar AlJābir This Week's Top Stories About Ethanol Fireplaces

Par Franziska Quimby

This Week's Top Stories About Ethanol Fireplaces

Par Franziska Quimby What's The Job Market For Crypto Casino Slots Professionals Like?

Par Dorris Brackman

What's The Job Market For Crypto Casino Slots Professionals Like?

Par Dorris Brackman The Most Important Reasons That People Succeed In The Robot Vacuum That Vacuums And Mops Industry

Par Darryl Cuper

The Most Important Reasons That People Succeed In The Robot Vacuum That Vacuums And Mops Industry

Par Darryl Cuper Slot Walk-Throughs 101"The Complete" Guide For Beginners

Par Archer Bunting

Slot Walk-Throughs 101"The Complete" Guide For Beginners

Par Archer Bunting