Another benefit is the flexibleness in utilization. Borrowers can utilize these funds for various functions, similar to medical emergencies, repairs, or surprising payments.

Another benefit is the flexibleness in utilization. Borrowers can utilize these funds for various functions, similar to medical emergencies, repairs, or surprising payments. This monetary breath of aid can facilitate a faster recovery from potential monetary cri

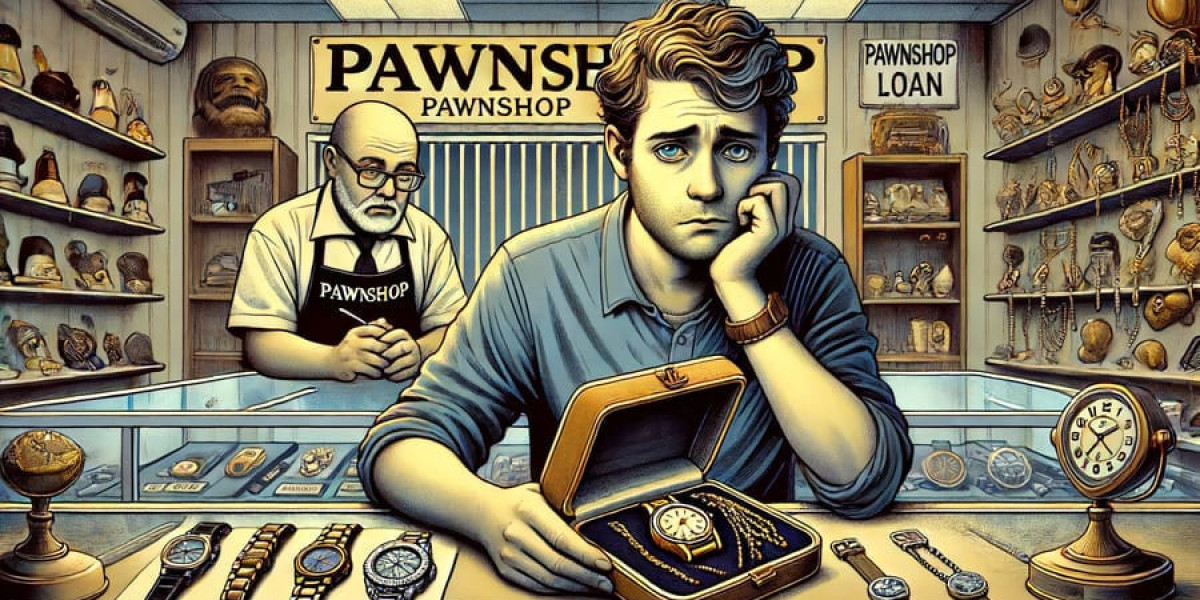

The Pros of Pawnshop Loans Pawnshop loans include a spread of benefits that appeal to many borrowers. First and foremost, *they are quick and straightforward*. Individuals can stroll right into a pawnshop and walk out with cash in hand inside Daily Loan a short interval. This immediacy is commonly essential for these going through sudden financial burd

It’s essential to learn the phrases and circumstances carefully earlier than accepting any loan. Some lenders may supply quick approval, however the hidden fees and interest rates might considerably impression your reimbursement functional

The benefits of obtaining a business loan are numerous. For one, they enable businesses to leverage funds for immediate expenses or investments, which could considerably affect development. Additionally, timely reimbursement of a business mortgage can improve a company's credit score rating, facilitating access to higher financing choices sooner or later. However, businesses must be cautious about their borrowing ranges and guarantee they'll meet reimbursement obligati

What is a Pawnshop Loan?

A pawnshop mortgage is a sort of secured mortgage in which an individual provides a priceless merchandise as collateral to acquire cash. The quantity loaned is often a fraction of the merchandise's appraised value, providing quick money while allowing the borrower to reclaim the item upon compensation. This transaction is normally straightforward: you bring an merchandise to the pawnshop, the pawnbroker assesses its value, and you receive a mortgage primarily based on that valuat

Eligibility Criteria for Auto Loans

Before applying for an auto mortgage, it is important to grasp the eligibility criteria that lenders typically search for. Generally, lenders assess the borrower's credit historical past, income degree, and current debt. A strong credit rating, usually above 700, might yield better mortgage phrases, together with decrease rates of inter

Typically, a single missed fee can lower the credit score by a number of factors, with subsequent missed funds causing much more harm. Therefore, it’s crucial to prioritize mortgage payments to maintain a wholesome credit score prof

At 베픽, you can entry detailed sources on varied monetary topics, together with strategies for dealing with delinquent loans and critiques of lender policies. With up-to-date data, customers are empowered to deal with financial challenges head

It's also essential for freelancers to manage their finances prudently, particularly when taking on debt. Developing strong budgeting abilities and understanding cash circulate can make a significant difference in compensation capabilit

If you efficiently repay your mortgage throughout the agreed interval, retrieving your collateral is seamless. Keep your

Loan for Credit Card Holders receipt in a safe place, as will probably be essential to reclaim your merchandise. Failing to return and settle the loan by the deadline may result within the pawnshop selling your pledged item to recuperate their pri

Another possibility is the lease-to-own association, where debtors initially lease a car with the option to purchase it on the end of the lease term. This could be enticing for many who wish to drive a new car without committing to a long-term mortgage instan

Additionally, pawnshop loans require no credit checks. This attribute is particularly useful for individuals with limited credit score histories or these experiencing monetary difficulties. As a secured mortgage, the quantity borrowed is typically decrease than traditional lending strategies, mitigating the monetary risk for the lender. As a result, debtors don’t have to worry about excessive credit scores or complicated utility proces

Managing Your Business Loan

Once obtained, the focus shifts to managing the loan effectively. Establishing a strong repayment strategy is important. Create a dedicated

Daily Loan finances to allocate funds specifically for mortgage repayments, which ensures that different operational prices aren't compromi

How to Qualify for a Freelancer Loan Qualifying for a freelancer mortgage can be extra accessible than traditional loans should you put together adequately. The first step includes assessing your credit score rating, as most lenders require a good credit score historical past. If your rating is below expectations, consider taking measures to enhance it earlier than making use

n A credit score rating of seven hundred or larger is generally thought of perfect for securing a good auto loan. Borrowers with scores on this vary may qualify for the most effective rates of interest, whereas those with scores beneath 600 may face higher charges or additional charges. It’s advisable for potential debtors to verify their credit report and handle any discrepancies earlier than making use

Slot Walk-Throughs 101"The Complete" Guide For Beginners

Par Archer Bunting

Slot Walk-Throughs 101"The Complete" Guide For Beginners

Par Archer Bunting This Week's Top Stories About Ethanol Fireplaces

Par Franziska Quimby

This Week's Top Stories About Ethanol Fireplaces

Par Franziska Quimby 신뢰할 수 있는 먹튀검증, 슈어맨이 답이다

Par Juli Alfonso

신뢰할 수 있는 먹튀검증, 슈어맨이 답이다

Par Juli Alfonso 안전한 게임을 위한 먹튀 보증 토토사이트의 필수 요소

Par Lyda Abner

안전한 게임을 위한 먹튀 보증 토토사이트의 필수 요소

Par Lyda Abner What's The Job Market For Crypto Casino Slots Professionals Like?

Par Dorris Brackman

What's The Job Market For Crypto Casino Slots Professionals Like?

Par Dorris Brackman